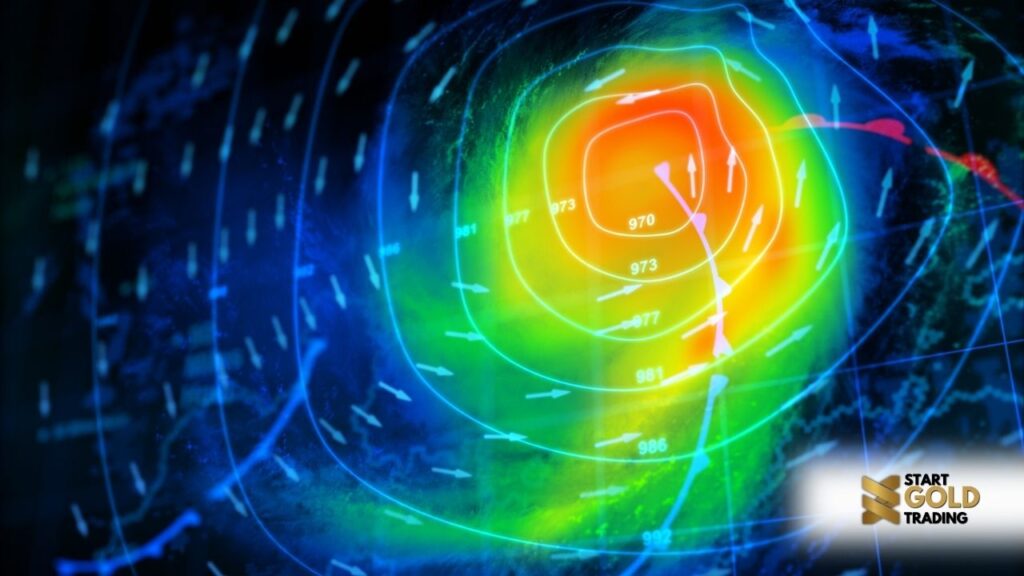

In the world of gold trading, economic events act like the weather systems of the financial markets, capable of stirring calm seas into tempestuous waves. For traders, especially those new to the gold market, understanding how these events influence gold prices and learning how to navigate them is crucial. This article aims to demystify the relationship between economic reports and gold price volatility and provide practical strategies for trading gold effectively during these times.

Impact of Major Economic Reports on Gold Prices

Economic events can have profound effects on the volatility of gold prices, much like how a storm can affect ocean tides. Key reports such as GDP announcements, employment data, and interest rate decisions can cause significant movements in the gold market. Here’s why:

- Interest Rate Decisions: Central banks’ decisions on interest rates can influence gold directly. Typically, lower interest rates make gold more attractive since it doesn’t offer yield, and vice versa.

- Inflation Reports: Gold is often seen as a hedge against inflation. High inflation rates can lead to higher gold prices as investors turn to gold to preserve their purchasing power.

- Employment Data: Strong employment numbers can strengthen a country’s currency, potentially lowering gold prices, and weak numbers can have the opposite effect.

Strategies for Trading Gold During Economic Announcements

Navigating gold trading during economic announcements requires a blend of preparation, caution, and agility. Here are some strategies to help you trade smarter:

- Stay Informed: Always keep an economic calendar handy. Knowing when significant reports are due will help you prepare your trading strategy in advance.

- Understand Market Expectations: It’s not just the actual economic data that affects the markets, but how it compares to market expectations. If an economic report is better or worse than expected, it can cause substantial price movements.

- Use Stop-Loss Orders: To protect against market volatility, use stop-loss orders to limit potential losses. This is like having a safety net in place in case the market moves sharply against your position.

- Practice Risk Management: Don’t overcommit to a single trade. Diversifying your trades and using only a small percentage of your capital on any given position can help manage risk.

Case Studies of Market Reactions to Past Events

Let’s look at some historical examples to understand how gold prices have reacted to major economic events:

- The Financial Crisis of 2008: During the global financial crisis, investors flocked to gold as a safe haven, pushing its price up as stock markets tumbled around the world.

- Brexit Vote in 2016: The uncertainty caused by the UK’s decision to leave the EU led to a sharp increase in gold prices as investors looked for stability.

- COVID-19 Pandemic: The onset of the pandemic and subsequent economic uncertainty led to record high gold prices in 2020, as gold was perceived as a safe store of value.

Conclusion

Understanding the impact of economic events on gold prices and developing effective trading strategies around these times are crucial skills for any gold trader. By staying informed, preparing for volatility, and employing smart risk management techniques, you can navigate the choppy waters of gold trading during major economic announcements. Remember, the goal is not just to survive these storms but to learn how to sail your ship skillfully through them, capitalizing on opportunities along the way.